Departamento de Relaciones Económicas Internacionales

Presentación

Coordinador: Esteban Leguizamón

Secretario: Marcos López Bustamante

Integrantes: Julieta Zelicovich

María Luján Pérez Mayer

Federico Borrone

Leila Mohanna

Pablo Bertín

Julio Sevares

Antonella Cabral

El Departamento de Relaciones Económicas Internacionales del Instituto de Relaciones Internacionales de la Universidad Nacional de La Plata presenta el Panorama de la Economía Internacional, que contiene las tendencias más destacadas de la economía y el comercio mundiales del último año a cargo de nuestro coordinador el profesor Esteban Leguizamon. El análisis se detiene, en primer lugar, sobre la evolución de las principales economías del mundo para luego describir los cambios más importantes del comercio. Esta presentación contiene a la vez comentarios sobre creencias, percepciones y pronósticos económicos; un aporte sobre el desempeño macroeconómico de Colombia antes y después de su acuerdo de paz; un análisis sobre la desindustrialización de Europa, un aporte sobre el uso del RMB, y un breve ensayo sobre la cuestión de las deudas soberanas.

Marcos N. Lopez Bustamante

Secretario

Panorama

Resilience and Adaptive Capabilities of the Global Economy to Recurrent Shocks

This analysis delves into the resilience and adaptive capabilities of the global economy in response to two different and consecutive shocks. As of 2020, it has become evident that the world as we knew it has undergone significant transformations. Economists continue to explore the intrinsic nature of economic shocks, which, in recent times, have delivered relentless blows to the world’s economic structure. These successive disruptions have tested various dimensions of the global order, defying the buffers meant to deal with such events. International trade, value chains, and every political and social structure faced two consecutive «external or unexpected» shocks: the COVID-19 pandemic and the Russia-Ukraine conflict, all within a span of less than five years.

West (2017) shows how urbanization and cities, defined as a “machine” that encourages social interactions, facilitated the exponential growth rate experienced by the world economy during the last century. Among his contributions, for our argument, it is noteworthy how order and patterns emerge when examined from the appropriate perspective. He demonstrates how to identify patterns that give rise to economies of scale in modern capitalism. However, his research also underscores a significant concern: the extensive networks designed to connect people in urban centers and generate positive externalities also have an unfortunate dual application to undesirable societal events (i.e., diseases, crime, increased contagion rates, etc.).

As the dawn of the aftermath of the COVID-19 pandemic emerged, the global economy commenced its recovery from the recession triggered by the lockdowns. Precisely when it was gaining momentum and reorganizing itself to address urgent relegated problems such as poverty, immigration, education, energy, and food production (supply), at this critical juncture, the conflict between Russia and Ukraine struck. Another straight punch that undoubtedly presents a formidable challenge to international institutions.

Following the reopening of its economy, China is experiencing a robust recovery. Because of its key role in the economic system, it can support both global demand and supply and act as a buffer while the economy recovers. Supply chain disruptions are gradually being resolved, and the distortions in energy and food markets caused by the conflict have entered a smooth path leading to a normalization of market behavior. At the same time, a concerted and synchronized tightening of monetary policy by the major central banks is expected to yield results, pushing inflation down toward their targets.

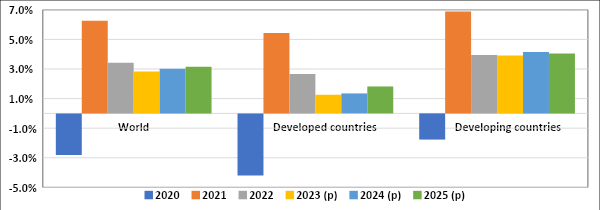

Developing economies exhibit better performances than developed ones, with growth rates surging from 2.8% in 2022 to a projected 4.5% in 2023. Growth deceleration within advanced economies is particularly noticeable in the eurozone and the United Kingdom. Figure 1 shows that developing countries are expected to stabilize their growth rate near 4% every year until 2025.

Figure 1: Real GDP growth IMF forecasts.

Source: Author’s elaboration based on IMF.

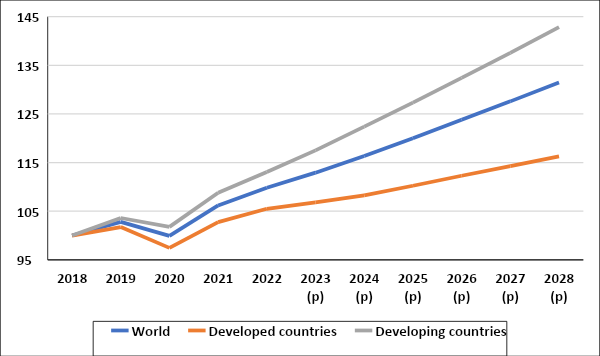

The former International Monetary Fund chief economist, Olivier Blanchard, argues that the Federal Reserve should force labor markets to remain stressed[1] if the target is a decrease in inflation. Beneath the surface, turbulence is gathering momentum, rendering the situation considerably fragile. Inflation has exhibited a stickiness exceeding policymaker’s prior, despite being in a downslope trend. Because of the lag by which monetary tightening measures operate, effects on output and employment should not be neither fully nor easily distinguishable while relative prices keep moving until “coordination” is reached. Nevertheless, against such expectations, both output and inflation estimates have experienced successive upward revisions. As it is shown in Figure 2 and follows from Figure 1, projected economic growth for developing countries outperforms projected values for developed ones.

Figure 2: GDP at constant prices index (2018=100)

Source: Author’s elaboration based on IMF.

Concerning the possibility of an uncontrolled wage-price spiral, the current scenario suggests that nominal wages are not keeping up with inflation, resulting in a decrease in real wages. Nonetheless, the tightness of the labor market makes it unlikely for this scenario to take place (IMF, 2023). It is worth noting that corporate margins have increased considerably in recent years, which offsets the significant rise in prices accompanied by only minor wage increases. This suggests that corporations are capable of accommodating the increasing labor costs regularly. The ability of any financial system to endure depends on its ability to handle such losses without requiring public funding assistance. The US banking sector displays significant vulnerabilities among both traditional and nontraditional financial institutions as a result of the collapse of a small group of regional banks. The authorities took swift and decisive measures to contain the spread of the crisis (IMF, 2023).

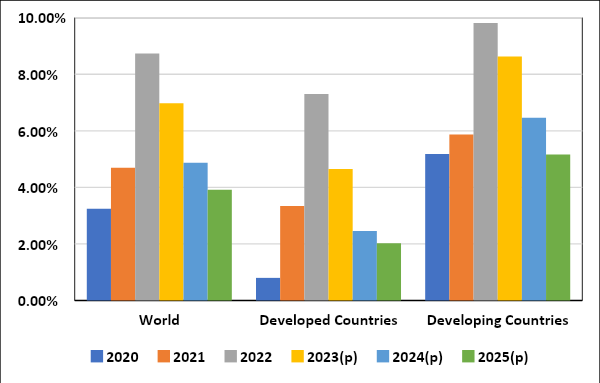

Amidst the described tightening financial conditions, it is important to consider the possibility of flight to quality uncoordinated episodes. This could lead to global GDP per capita teetering on the edge of a precipice. Therefore, the heterogeneity of projections and performance emphasizes the importance of effective policymaking and clear communication. Financial entities that are excessively leveraged and prone to credit risk or interest rate fluctuations are exposed and may become potential targets for investors. Additionally, countries that exhibit weak fundamentals may come under the scrutiny of investors who are not averse to low risk. Restoring critical fiscal buffers and enhancing financial resilience can only be achieved through precise and feasible regulations. According to Figure 3, the average consumer prices inflation for each year and a group of countries indicate that the shock caused by the war resulted in a significant acceleration in price increases.

Figure 3: Inflation average consumer prices.

Source: Author’s elaboration based on IMF.

According to the explanation given while analyzing Figures 1 and 2, inflation reached unusual highs last year in many economies, leading central banks to tighten aggressively their policy to keep inflation expectations anchored as discussed before. Agents anticipated the deceleration of economic activity, due to the increase in interest rates. Regulatory institutions were tested and stressed. Therefore, tensions between different segments of the financial system, prompt concerns surrounding financial stability. Robust liquidity and capital positions within banks appeared to absorb the effects of monetary policy.

International trade performance facts and perspectives:

Global trade is returning to pre-COVID-19 levels in consistency with GDP and inflation performance, although modified flows and supply chains. As Sevares (2023) notes in this yearbook on the renminbi-dollar dispute as the primary reserve currency, China requires a liquid and comprehensive RMB credit market to facilitate cross-border payments and encourage RMB-denominated international transactions. Additionally, the financial architecture and capital flows continue to adjust to the emerging geopolitical structure.

Data and projections between April and August 2023, used as input in Table 1, show that Emerging Markets and Middle East and Central Asia are the only groups of countries expected to experience a decline in exports in 2023 compared to their 2022 performance.

Table 1: Exports and imports growth dynamics – Path and projections.

| 2019 | 2020 | 2021 | 2022 | 2023 (p) | 2024 (p) | |

| Exports | ||||||

| Advanced economies | -1.6 | -9.7 | 21.8 | 9.3 | 3.5 | 4.7 |

| Euro area | 2.2 | -13.1 | 11.6 | 8.0 | 2.7 | 3.3 |

| Emerging markets and developing economies | -1.5 | -9.4 | 30.1 | 14.8 | -1.6 | 5.2 |

| Latin America and the Caribbean | -1.8 | -13.8 | 27.9 | 18.8 | 2.7 | 5.6 |

| Middle East and Central Asia | -5.4 | -24.2 | 36.4 | 36.6 | -9.7 | 1.0 |

| Imports | ||||||

| Advanced economies | -1.2 | -9.5 | 21.2 | 12.9 | 1.9 | 3.8 |

| Euro area | 2.5 | -10.5 | 10.8 | 8.2 | 2.6 | 2.9 |

| Emerging markets and developing economies | -1.5 | -11.2 | 27.8 | 12.9 | 2.8 | 6.1 |

| Latin America and the Caribbean | -3.0 | -17.6 | 34.8 | 21.3 | 1.1 | 5.1 |

| Middle East and Central Asia | 0.1 | -16.2 | 14.6 | 22.7 | 0.6 | 5.7 |

Source: Author’s elaboration based on IMF and WDI.

Numerous economic sanctions have been imposed on the Russian Federation since the beginning of the conflict. According to Table 2, the Ruble appreciated by 8.34% in the first seven months of the conflict. Despite the predictions of many economists that the Russian currency would depreciate, capital controls were imposed by Russia’s monetary authorities, and Putin mandated that ‘unfriendly countries’ must pay for gas in rubles. These actions led to a sharp increase in Ruble demand.

Table 2: Ruble exchange rate behavior since the Russia-Ukraine conflict began.

| 31/12/2021 | 75.00 |

| 31/3/2022 | 70.25 |

| 30/6/2022 | 62.26 |

| 30/9/2022 | 64.39 |

| 31/12/2022 | 71.48 |

| 31/3/2023 | 77.65 |

| 30/6/2023 | 89.01 |

Source: Author’s elaboration based on IMF.

Due to economic sanctions, appreciation could not last forever, but, remarkably, not well-coordinated economic policy may lead to undesirable results.

The situation is currently too uncertain to make definitive claims, but Latin American countries should approach negotiations with caution while recovering. They should seize every opportunity that arises to gain access to new markets. Prudent and coordinated measures must be taken until the global economy stabilizes.

Focusing on our neighborhood:

For Latin American countries, the net effects of the Russia-Ukraine conflict are difficult to disentangle. The main issue is the trade-off between higher import prices for industrial inputs and higher export prices for primary products. A short-term opportunity to establish a solid foundation for long-term sustainable growth exists. So as China maneuvers to establish the RMB as a reserve currency, a door to liquidity remains open. Although current account deficits are undesirable, their financial counterpart can be used if the RMB-dollar battle results in less expensive liquidity.

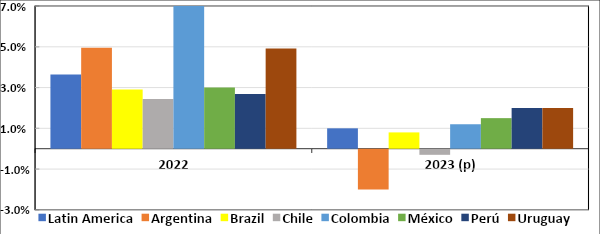

Figure 4: Realized and projected GDP growth rate – Latin America (selected countries)

Source: Author’s elaboration based on IMF.

Although Argentina is negotiating with IMF authorities while experiencing an economic crisis with inflation rates over 100% a year and undergoing an election process, Chile is the only country expected to face an economic contraction.

It has become evident that political stability is necessary to establish the rules required for economic growth in the region. For the attainment of lasting economic stabilization, solid institutional structures are a prerequisite. When viewed from this perspective, the economic system moves towards a path in which the macroeconomic environment prevents a regression to instability and stagnation.

Apart from Argentina, the case of Peru is notable as the country has had five different presidents since 2018, averaging one per year. In addition, Chile rejected a new constitution in a national plebiscite last September while Brazil elected Luiz Inácio Lula Da Silva as the new president to replace Bolsonaro. The current heterogeneity of each country’s political reality makes it difficult for the region to act as a cohesive block with shared interests.

What is next?

The Economic Commission for Latin America and the Caribbean (ECLAC) predicts a complex situation for the last quarters of 2023 and 2024, especially for Latin American countries. As mentioned earlier, the region’s forecasts predict a slow recovery that will be significantly affected by global factors such as the strict monetary policy of the US, the conflict between Russia and Ukraine, and the dispute between RMB and USD.

- Higher interest rates have a direct impact on the expected performance and cash flows of heavily indebted economies. According to Guzmán (2018), the misconception lies in treating liquidity and solvency as separate concepts. If there was a strong perception of debts being sustainable, illiquidity would not be a concern.

- Prices of agricultural commodities continue to fluctuate erratically. Russia’s dominant position in the nitrates market for fertilizers remains one of the main factors driving cost increases. Countries with a strong agricultural sector, such as Brazil and Argentina, have to pay a high price to find alternative ways of securing fertilizers due to Russia’s dominance in this market.

- According to Sevares (2023), China’s attempt to challenge the global dominance of the USD by promoting the international use of the RMB is unlikely to succeed. Nonetheless, it is probable that a multipolar world with several major currencies will emerge, where the dollar will continue to be the primary currency with RMB playing a subordinate role. The reason for this is that the use of emerging market currencies in international trade is on the rise, leading to a diversification of currencies.

This analysis begins by explaining the concept that the global economy is a complex adaptive system that experiences continuous shocks and evolves in response. It achieves this by questioning the resilience of the economic system and its ability to adapt to a dynamic environment. The system’s performance arises from countless interactions, reactions, and decisions. Based on our current understanding, when enquired about the system’s status or its future behavior, the most accurate response would be, ‘It depends.’ What is important is providing a precise response to the most likely reply: ‘What does it depend on? ‘ Establishing causation in this type of system is a challenging task. Therefore, as done above, in some cases the best practice is to isolate facts, describe them, and reason about how they fit into the system and their role. In this section, points 1, 2, and 3 attempt to do so.

Esteban Javier Leguizamón

Coordinador

Bibliographic references

Economic Commission for Latin America and the Caribbean (ECLAC), 2022. Economic survey of Latin America and the Caribbean.

Levin, J. 2022. “Fed Splits the Difference on Labor Market Pain”. Available at https://www.washingtonpost.com/business/fed-splits-the-difference-on-labor-market-pain/2022/09/21/a16f02c6-3a02-11ed-b8af-0a04e5dc3db6_story.html

Guzmán, M. 2018. “The Elements of Sovereign Debt Sustainability Analysis”. Available at https://martinmguzman.files.wordpress.com/2018/10/guzman-inet18.pdf

Sevares, J. 2023. “Uso internacional del RMB. ¿Desplaza al dólar?”. Institute of international relations yearbook. La Plata University, Argentina.

West G., 2017, Scale. “The universal laws of growth, innovation, sustainability, and the pace of life in organisms, cities, economies, and companies”, New York, Penguin Press.

World Economic Outlook. 2019-2023 editions. International Monetary Fund

World Development Indicators. World Bank.

Actividades

Investigación

Participación de Esteban Leguizamon como miembro del Departamento de Investigación del Banco Interamericano de Desarrollo- Consultor modo PEC – Proyecto “Climate Change Natural disasters and Economic Growth”.

Participación de Julio Sevares como miembro del Grupo de Trabajo sobre China del Consejo Argentino para las Relaciones Internacionales.

Publicaciones

- Elaboración del Panorama de la Economía Internacional para el Anuario IRI 2022.

- Elaboración del Panorama de la Economía Internacional para el Anuario IRI 2023.

Otras actividades

- Convocatoria a nuevos miembros del departamento de Relaciones Económicas Internacionales.

- Participación de Federico Borrone como Secretario de la Especialización en Estudios Chinos.

- Participación de Federico Borrone como Coordinador del Centro de Estudios Canadienses.

- Dirección de tesis doctoral del Doctorado en Relaciones Internacionales del IRI.

- Dictado de seminarios en la Maestría en Relaciones Internacionales del IRI.

- Participación de miembros del departamento como revisores de artículos para la Revista del IRI.

- Actualización de la página del Departamento de Relaciones Económicas Internacionales.

- Presentación de libro en coautoría Marcos N López Bustamante en el libro “Fuentes del Derecho Internacional, Casos y Prácticas. Claudia G. Gasol Varela (Dir) Bs.As. 2022”., Facultad de Derecho, UBA (septiembre 2022)

- Participación de los miembros del Departamento en X Congreso de Relaciones Internacionales del IRI (noviembre 2022, La Plata). Mesa homenaje al profesor Daniel Berrettoni.

- Participación de los miembros del departamento como revisores de artículos para la Revista del IRI.

- Participación de miembros del departamento como jurado de Tesis de Maestría.

- Participación de miembros del departamento en la “Mesa Homenaje al Profesor Daniel Berrettoni” en el XI Congreso de Relaciones Internacionales del IRI-UNLP.

- Congratulacion de Pablo Bertin por su premio como ganador del concurso de ensayos sobre ASEAN 2022/2023, categoría graduados universitarios, organizado por las embajadas de miembros del comité de la Asociación de Naciones del Sudeste de Asia (República de Indonesia, Malasia, República de Filipinas, Reino de Tailandia y República Socialista de Vietnam).

- Participación de Pablo Bertin como ponente en la conferencia “Regionalismo-Multilateralismo desde una perspectiva del comercio internacional” organizado por el IRI-UNLP.

- Participación de Pablo Bertin como Ayudante de Primera en la asignatura “Economía Internacional” en la Facultad de Ciencias Económicas de la Universidad de Buenos Aires.

- Participación de Pablo Bertin como co-tutor en tesinas de grado en la Facultad de Ciencias Económicas de la Universidad de Buenos Aires.

- Participación de Pablo Bertin como co-coordinador del Grupo de Trabajo del Mercosur del Comité de Estudios de Asuntos Latinoamericanos del Consejo Argentino para las Relaciones Internacionales (CARI) en la organización de seminarios y conferencias.

- Participación de Pablo Bertin como jurado del Concurso Federal de Ensayos 2022 (categoría graduados y estudiantes universitarios avanzados) dentro del Grupo Joven del CARI.

- Participación de Julio Sevares como profesor de la Maestría en Historia Económica y de las Políticas Económicas de la Facultad de Ciencias Económicas de la Universidad de Buenos Aires.

- Participación de Julio Sevares como profesor de la Especialización en Estudios Chinos del IRI-UNLP.

- Participación de Esteban Leguizamon como Director de Tesis de Maestría en Economía.

- Participación de Esteban Leguizamon como jurado de Tesis de Maestría en Economía en la Facultad de Ciencias Económicas de la Universidad Nacional de La Plata.

- Participación de Esteban Leguizamon como docente del curso “Economía Internacional, instituciones y problemas corrientes” de la Maestría en Marketing Internacional de la Facultad de Ciencias Económicas de la Universidad Nacional de La Plata.

- Participación de Esteban Leguizamon como docente del curso “Macroeconomía I” de la Facultad de Ciencias Económicas de la Universidad Nacional de La Plata.

- Participación de Marcos N. Lopez Bustamante como Ayudante de segunda del Curso Profesional Orientado “Las Fuentes del Derecho Internacional”, Catedra Buis-Gasol Varela de la Facultad de Derecho de la Universidad de Buenos Aires.

- Participación de Marcos N. Lopez Bustamante como Jefe de Trabajos Prácticos (i) de la asignatura “Derecho Internacional Público” de la Cátedra Buis de Derecho Internacional, de la Facultad de Derecho de la Universidad de Buenos Aires.

[1]https://www.washingtonpost.com/business/fed-splits-the-difference-on-labor-market-pain/2022/09/21/a16f02c6-3a02-11ed-b8af-0a04e5dc3db6_story.html